Quote, Wizard. affordable car insurance. com LLC makes no representations or guarantees of any kind of kind, express or indicated, as to the procedure of this site or to the information, content, materials, or products included on this site. You specifically concur that your usage of this website is at your sole threat.

It depends. When you inform the various other party's insurance coverage business of your claim, you must ask if you are entitled to payment for a rental auto or various other replacement transportation. While the insurance provider should inform you just how much they would permit a rental cars and truck or various other transportation, they do not have to commit to making any repayments till it ends up being sensibly clear that their insurance holder was legitimately in charge of the accident.

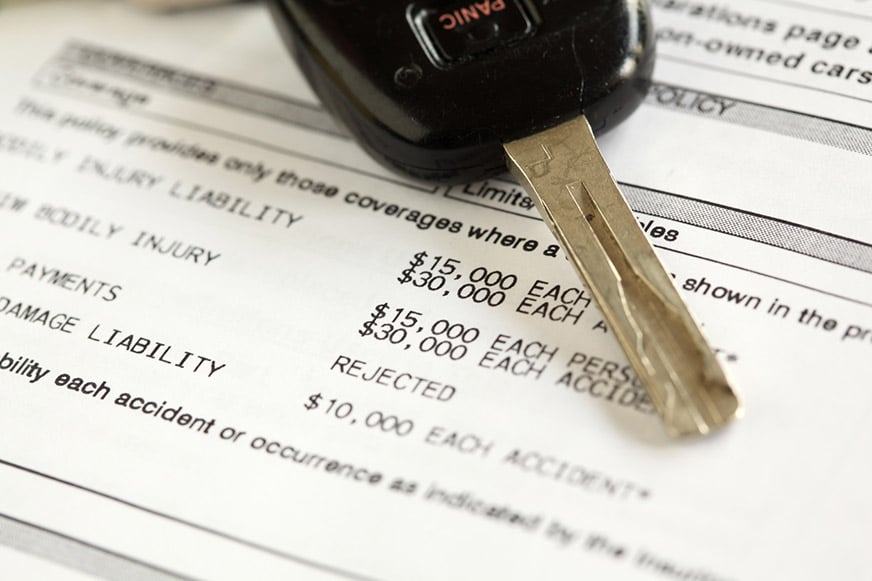

New Jersey insurance policy guidelines require an at-fault chauffeur's insurance policy business to repay you for the cost of a rental car in proportion to their liability. If the insurance coverage business enables $30 a day to rent out an automobile and their insured was located to be 60% at fault, they would just reimburse $18 a day to rent out a vehicle.

00 daily), the insurance provider needs to tell you where you can lease a vehicle for that quantity. cheap auto insurance. An insurance firm is only obliged to reimburse you for a rental cars and truck, or various other alternative transportation, through of time until the harmed vehicle is fixed or, in the occasion of a failure, up until the claim is cleared up.

Your Home Insurance Coverage Could Be Cancelled If you don't make a settlement within the moratorium, your insurance carrier deserves to terminate your policy - vans. If your insurance coverage gaps, you will not have any type of security for your house and ownerships as well as you'll have to shoulder the prices if the worst happens.

Worse, your lending institution might make a decision to seize on the building. Yes, you may lose your house if you do not pay your insurance coverage costs. Your Credit Rating Could Take a Dive If you have impressive property owners insurance premiums, your provider could send out the financial debt to collections. This will certainly have a negative influence on your credit score ranking you can anticipate your score to drop.

How I Totaled My Car And Still Owe Money On The Loan. What Now? can Save You Time, Stress, and Money.

cars insurance company affordable car insurance cheapest auto insurance

cars insurance company affordable car insurance cheapest auto insurance

insurance affordable risks auto accident

insurance affordable risks auto accident

Yet, it's ideal to go shopping around while you're still current on your house owners insurance policy by doing this, it will certainly be a lot easier to switch to another service provider to get less expensive insurance coverage - insurance affordable. What happens if that ship has cruised? An independent agent can still assist you discover the insurance coverage you need at the most affordable possible rate, yet you may have less alternatives with a lapse in your home owners insurance coverage.

Our very experienced team can compare policies from loads of carriers to locate the ideal bargain.

You may, nevertheless, need to pay tax obligations on a few of the money value if the sum surpasses what you have actually paid in costs. There may be a "lowered paid-up" choice. This indicates that you can quit paying costs totally in return for a minimized fatality benefit and also no cash money conserving.

Some insurance companies might allow this if you do it within five years of lapsing. Annual costs for the restored policy might be reduced than those for a brand-new, similar plan.

When your budget plan is limited, you might be lured to reduce corners wherever you can. Prior to missing a payment or calling to cancel, check out on to find out about the consequences of protection voids, what to do if your policy lapses, and also when it can make feeling to quit your coverage.

vehicle insurance auto car insurance insure

vehicle insurance auto car insurance insure

If you let your insurance coverage lapse since you're not driving today, you can still sustain fines or high prices when you begin driving once more. insured car. If your insurance lapsed, ask to be restored by your insurer or ask a friend or member of the family to provide you as a driver on their plan.

Can My Car Insurance Company Cancel My Policy If I Pay Late? - An Overview

What Occurs When You Allowed Your Automobile Insurance Coverage Lapse? You marketed your only cars and truck. Your only vehicle was in an accident.

The repercussions vary by your state and also circumstance. Even more, some states have systems to immediately alert the department of motor cars when a chauffeur's insurance coverage gaps.

In Idaho, motorists without protection for 2 successive months are provided 30 days to obtain coverage or their registrations are put on hold. Personal Liability for Crashes If you're discovered to be at fault in an accident while driving without insurance, you could be gone to economic difficulty without insurance.

That suggests if you have actually been continually insured, your costs will certainly be lower than drivers who have had coverage spaces. If you take a break from having coverage, you'll likely face higher prices when you restore coverage. Stopping an Insurance Lapse Rather than letting your insurance gap, take into consideration all your alternatives.

Think very carefully with all the pros as well as cons of terminating automobile insurance coverage., you have a great opportunity of being reinstated.

Depending on how much time the lapse has been, you may have the ability to get your insurance renewed without a pause in coverage. You may be charged additional premiums for expiring, yet it will still normally be more affordable than the prices you obtain if you're thought about risky. Join Somebody Else's Policy If your policy has actually lapsed yet you do not intend to reinstate it, you can ask a pal or relative to add you to their plan - vehicle insurance.

The smart Trick of What Happens When Your Car Is Totaled? - Usaa That Nobody is Talking About

As long as you're listed as a vehicle driver on an insurance plan, you will not be dealt with as risky when getting insurance in your name - car. Numerous auto insurance firms will certainly require you to reside in the same permanent home as the major insured individual. As long as you live with each other, you can sign up with the plan as a motorist and you will be covered if you drive their automobile.

Exists a Moratorium Before the Lapse Is Official? Moratorium provide you a quantity of time in between a missed out on settlement as well as a cancellation that would certainly result in a gap in coverage. States call for insurance firms to notify policyholders prior to canceling their plan, as well as the moratorium generally varies from 10 to 20 days - cheap car.

Driving without insurance protests the legislation in many states, as well as it can likewise wind up being pricey. Consider the consequences as well as options thoroughly to make the very best decision for today and the future. Regularly Asked Questions (FAQs) Exactly how do I change car insurance without a lapse? To guarantee you do not have a lapse in cars and truck insurance policy protection, make sure you enroll in a brand-new auto insurance coverage policy prior to canceling your existing one - cheap insurance.

When does a life insurance plan gap? Comparable to a car insurance coverage policy, a life insurance policy will certainly lapse if you don't make your costs payment before the moratorium runs out. That said, your insurance firm should notify you if your plan is in danger of lapsing. The elegance period can vary by state and insurance firm.

Much like with any repeating expense, you require to pay your car insurance policy costs routinely or your insurer will quit giving coverage. Yet unlike a missed phone expense, the consequences of missing an insurance policy settlement can be significant. After a termination for a missed repayment, the insurance provider can raise your rates and also your certificate may be revoked. cheap insurance.

It's important that you call your insurance firm as quickly as you realize you're behind on your insurance policy repayments. What to do if you can't afford or miss out on a cars and truck insurance payment As soon as you understand you will likely miss or have already missed a car insurance coverage settlement, call your insurance company to allow them recognize you're mindful of the circumstance as well as ask what you can do following (money).

Not known Facts About No Proof Of Insurance In Georgia - Driving Laws

insurers insurance affordable business insurance credit

insurers insurance affordable business insurance credit

If you have actually missed repayment by a few days If you have actually just missed the payment by a couple of days to a week, you likely can renew your policy without a lapse in coverage or various other major effects, as you're still in the moratorium. You'll need to pay the Learn more quantity you missed out on, typically with a late repayment cost.

It's unlawful to drive without insurance in almost every state, so as soon as your insurance policy is terminated, you won't be able to drive. The longer you do without coverage, the larger the rate boost will be when you buy a new policy - perks. It's complimentary, simple and protected. After you have insurance once again, you ought to contact your state's department of electric motor vehicles to update your insurance policy information and verify that your enrollment and also chauffeur's certificate are still legitimate.

It might at some point pass any past due financial debts to a collection firm. What takes place when your automobile insurance is canceled for missing out on a repayment? If you miss out on a vehicle insurance coverage settlement, you'll get a legitimately called for notification of cancellation from your insurance company. This notice may can be found in the mail or by a call or email.

The exact amount of time differs by state. After that, your insurance will officially lapse as well as you'll no more be able to drive your auto lawfully. In some states, allowing your insurance lapse likewise invalidates your enrollment either right now or a couple of weeks after your insurance gaps. No issue where you live, the longer you wait before remedying the problem, the better the repercussions will certainly be.

Long-term repercussions of terminated insurance coverage as a result of missed repayments If your car insurance policy lapses or is canceled, whether it's as a result of nonpayment or any other reason, you will likely face financial ramifications of some kind. The effects can continue also after you have actually renewed your insurance - vans. Right here are some feasible outcomes of missing your auto insurance coverage repayments.

As an example, in New york city, motorists need to pay $8 per day for as much as thirty days throughout which their insurance coverage was lapsed, with boosted charges thereafter.: Almost every state calls for drivers to insure their vehicles in order to register them, and many states require insurance provider to notify them if you let your insurance gap.

Faqs About Auto Insurance - Nc Doi - Truths

automobile cars affordable auto insurance dui

automobile cars affordable auto insurance dui

You might also be required to carry an if you are captured driving while without insurance, especially if you trigger an accident - low-cost auto insurance.: Insurance policy firms like to see that chauffeurs can reliably pay their costs on schedule every month. People who let their protection gap, even for a short quantity of time, will likely see a boost in automobile insurance rates the next time they restore.

If your car lending institution figures out you are not bring insurance on the automobile, it might reclaim the car.: If you owe cash on your cars and truck insurance coverage and your insurance firm passes the financial debt to a debt collector, it will likely influence your credit rating. This can affect your ability to get a credit rating card or finance, and the defamatory mark will certainly stay on your credit rating record for approximately seven years.